The business world in 2025 stands at a fascinating crossroads of technology and human expertise- Hybrid Bookkeeping. Nowhere is this more evident than in financial management, where AI-powered automation has transformed traditional bookkeeping. Yet, despite remarkable technological advances, the most successful businesses aren’t choosing between automation and human expertise – they’re leveraging both. At AIG Business Services, we’ve pioneered this hybrid approach, delivering superior results for businesses across transportation, eCommerce, and various service industries.

The Rise of Automated Bookkeeping

Remember the days of manual ledgers and spreadsheet nightmares? Those days are firmly behind us. Today’s automated bookkeeping systems can:

Process transactions with lightning speed, categorising expenses and income without manual input. What once took hours now happens in seconds, with AI algorithms learning your business patterns to improve accuracy over time.

Generate real-time financial reports that update as transactions occur. This instant visibility gives business owners unprecedented insight into their financial position at any moment, rather than waiting for month-end reconciliations.

Integrate seamlessly with other business systems, from payment processors to inventory management. This connectivity eliminates data silos and reduces the risk of errors from manual data transfer.

Flag potential issues automatically, from unusual transactions to compliance concerns. These early warning systems help businesses address problems before they escalate into costly mistakes.

The automation revolution has delivered undeniable benefits: reduced data entry, fewer calculation errors, faster processing, and significant time savings. For many small businesses, these tools have made professional-level bookkeeping accessible and affordable.

The Irreplaceable Human Element

Despite these technological marvels, purely automated systems have significant limitations. Here’s where human expertise remains essential:

Strategic financial interpretation goes beyond numbers to understand the story behind them. While AI can tell you that expenses increased by 15%, an experienced bookkeeper can explain why this happened and what it means for your business.

Industry-specific knowledge allows human bookkeepers to apply relevant context to your financial data. In transportation, for instance, understanding how to properly categorise expenses related to fleet maintenance or fuel surcharges requires specialised expertise.

Relationship-based financial management means having someone who understands your business goals, challenges, and opportunities. This personalised approach ensures your financial management aligns with your broader business strategy.

Complex compliance navigation, especially in highly regulated industries, requires human judgment. Tax laws and financial regulations continue to evolve, and the implications often require nuanced interpretation that automation cannot provide.

The real value comes from human bookkeepers who can leverage technology rather than be replaced by it. They use automation to handle routine tasks while focusing their expertise on analysis, strategy, and personalized guidance.

The Hybrid Approach:

Best of Both Worlds At AIG Business Services, we’ve developed a hybrid model that maximises the strengths of both automated systems and human expertise:

Automated data capture and entry eliminates manual input, reducing errors and saving time. Our systems automatically import transactions from your bank accounts, credit cards, and payment platforms.

AI-powered categorisation learns your business patterns to accurately classify transactions, while our human experts review and refine these categorisations to ensure accuracy.

Real-time financial dashboards give you instant visibility into key metrics, while our bookkeeping professionals provide regular insights and explanations that put these numbers in context.

Automated compliance checks flag potential issues, which our experts then evaluate and address with industry-specific knowledge and experience.

Strategic financial guidance from professionals who understand both your numbers and your industry helps you make informed decisions about growth, investment, and operational improvements.

This hybrid approach delivers superior results compared to either purely automated or traditional manual bookkeeping. It combines efficiency with expertise, speed with strategy, and technology with human touch.

Real-World Applications Across Industries The benefits of hybrid bookkeeping vary across industries, but the impact is consistently positive:

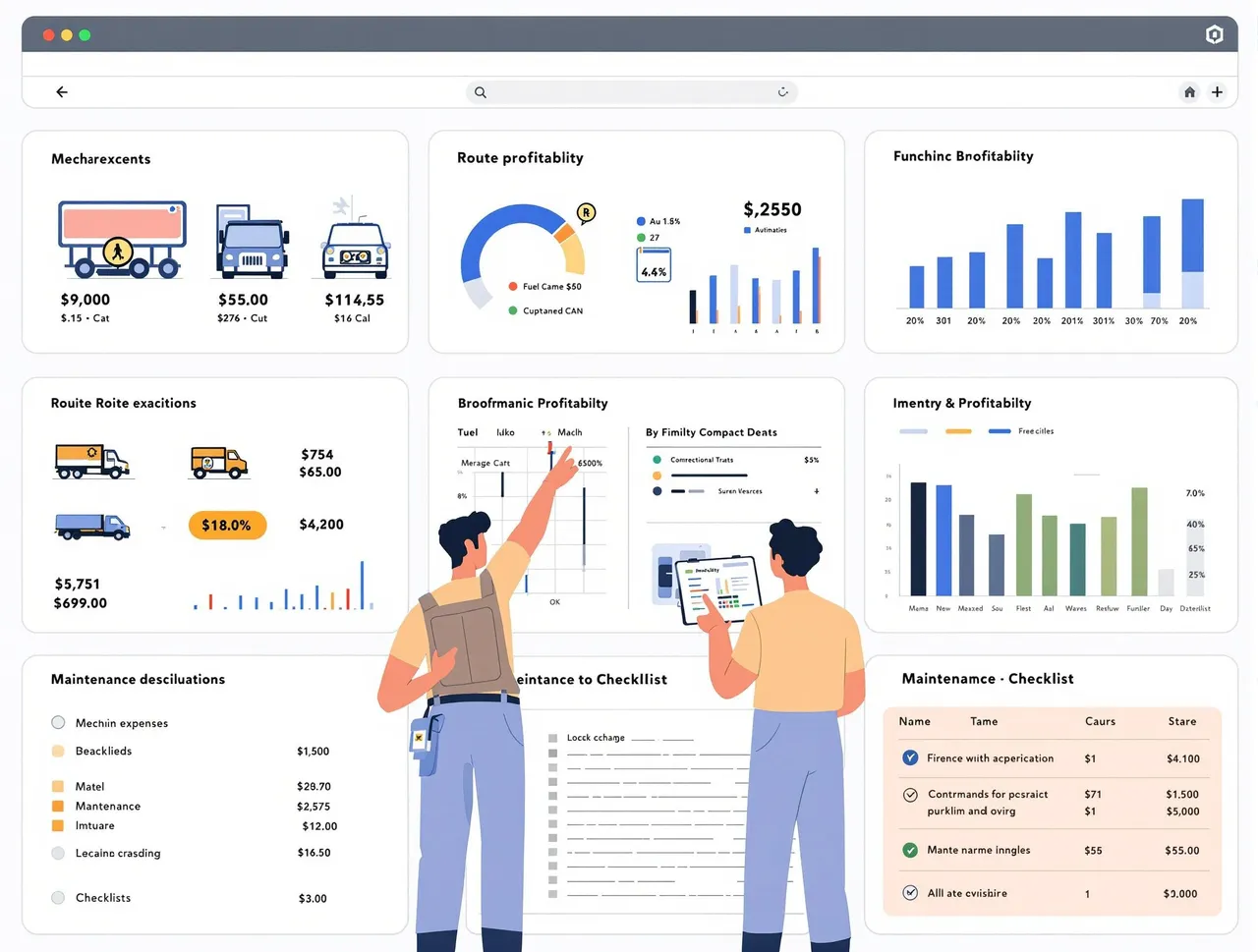

Transportation and Logistics: Fleet-based businesses benefit from automated tracking of per-vehicle expenses combined with human expertise in managing complex aspects like IFTA reporting, maintenance cost analysis, and route profitability.

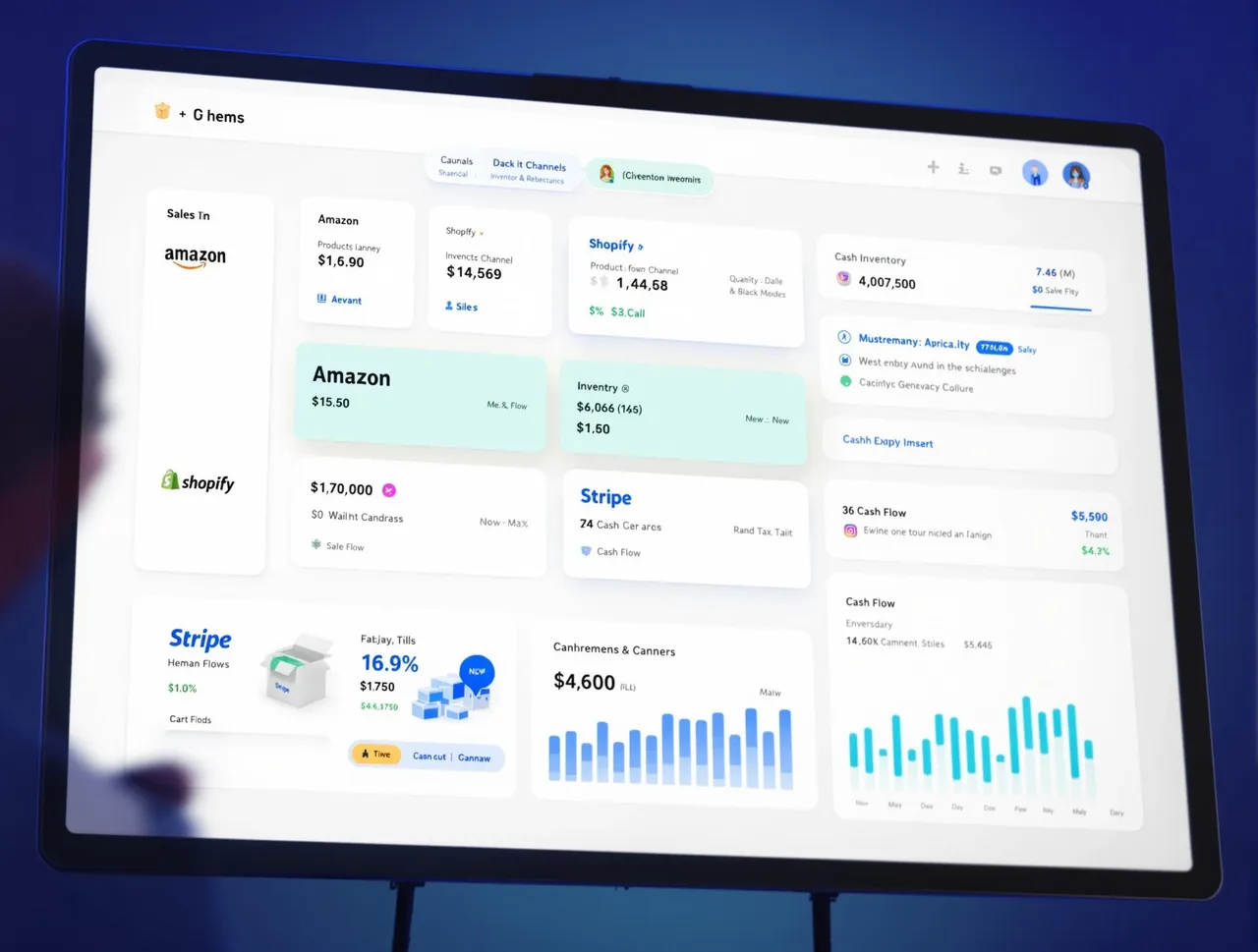

eCommerce: Online retailers need automated integration with multiple sales channels and payment processors, plus human guidance on inventory valuation, sales tax compliance across jurisdictions, and cash flow management during seasonal fluctuations.

Service Businesses: Professional service firms benefit from automated time tracking and invoicing, complemented by human expertise in project profitability analysis and resource allocation.

Real Estate: Property management companies need automated rent collection and expense tracking, plus human guidance on depreciation strategies, tax planning, and investment analysis.

The AIG Difference:Fixed-Price Excellence What truly sets AIG Business Services apart is our commitment to delivering this hybrid approach at a truly fixed price starting at just $265/month. This transparent pricing model eliminates the uncertainty that comes with hourly billing, allowing businesses to budget confidently while accessing both cutting-edge technology and professional expertise.

Our approach includes:

- Daily reconciliation using automated systems with human verification

- Real-time financial reporting through intuitive dashboards

- 24/7 support from knowledgeable professionals

- Industry-specific expertise, particularly in transportation and logistics

- Strategic financial guidance to support business growth

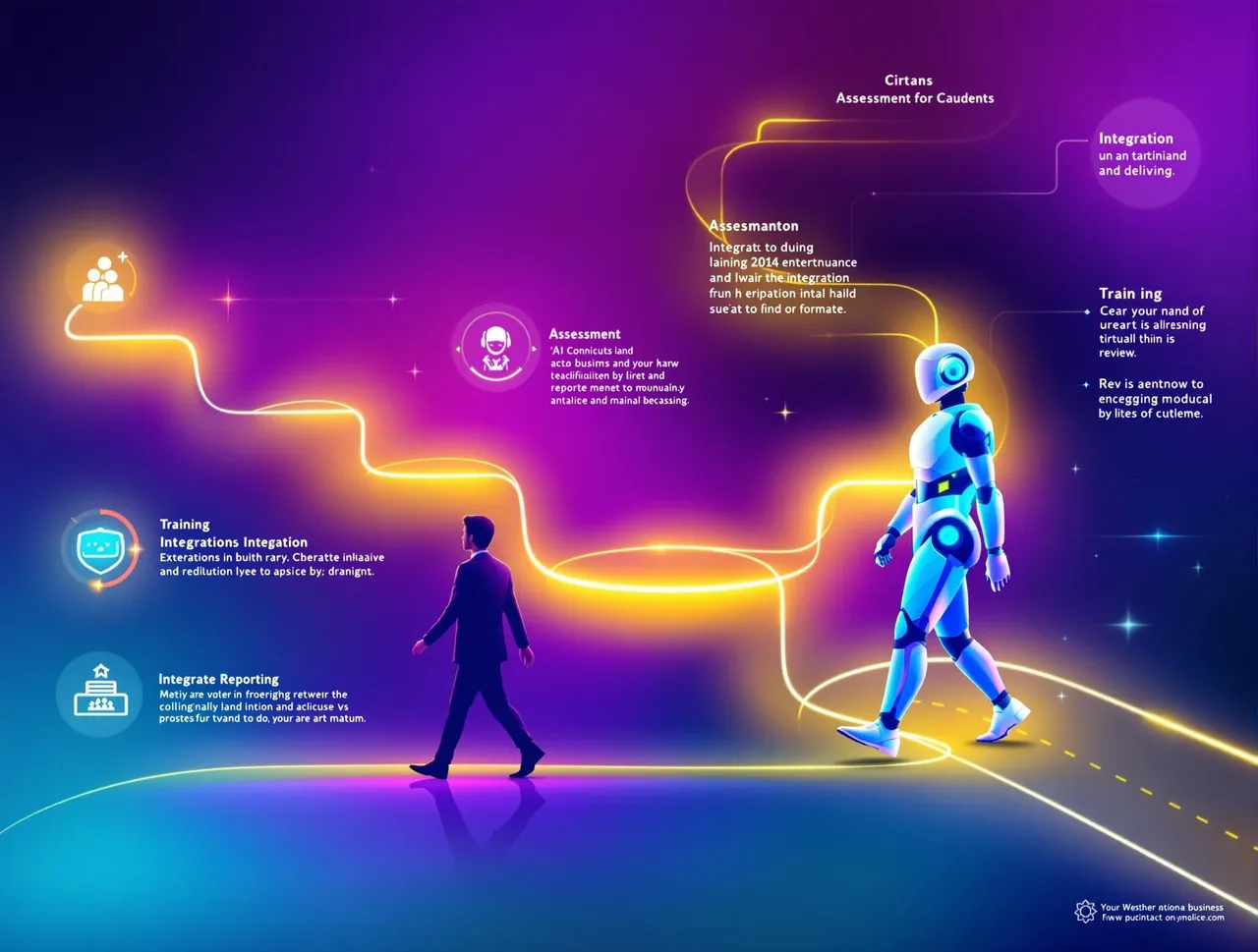

Implementation: Making the Transition Moving to a hybrid bookkeeping model doesn’t have to be complicated. Here’s how successful businesses make the transition:

- Assess your current systems and identify integration opportunities

- Establish clear processes for the human-technology partnership

- Invest in training to maximise the benefits of automation

- Develop reporting that combines automated data with expert analysis

- Regularly review and refine your approach as technology evolves

The Future of Bookkeeping

As we look ahead, the partnership between automation and human expertise will only grow stronger. AI capabilities will continue to advance, handling increasingly complex tasks, while human bookkeepers will evolve into more strategic advisors. The most successful businesses will be those that embrace this complementary relationship rather than viewing it as an either/or proposition.

Conclusion: In 2025, the question isn’t whether to choose automated or human bookkeeping – it’s how to best combine them for maximum benefit. At AIG Business Services, our fixed-price model delivers this optimal hybrid approach, giving businesses the efficiency of automation and the strategic value of human expertise without unpredictable costs.

Ready to experience the benefits of hybrid bookkeeping? Contact AIG Business Services today at +1-(833) 313-4996 or email finance@aigbiz.com to schedule your free 30-minute discovery call. Let us show you how our $265/month fixed-price service can transform your financial management.