It’s 2 AM on a Tuesday night, and your phone buzzes with a notification from your favorite load board. A high-paying load just posted: Dallas to Denver, $2,800 for 920 miles – that’s over $3 per mile! Without hesitation, you book it. After all, anything over $2.50 per mile is good money, right?

Fast forward three weeks later, when you finally sit down with your receipts and calculator. After factoring in fuel costs, tolls, truck payments, insurance, and that unexpected tire blowout in Oklahoma, you realize this “profitable” load actually cost you money. Sound familiar?

This scenario plays out thousands of times every day across America’s trucking industry. The problem isn’t that truckers don’t understand business – it’s that their operational decisions and financial tracking exist in completely separate worlds. At AIG Business Services LLC, we’ve spent years bridging this gap, and today we’re going to show you exactly how we connect your day-to-day operations directly to your financial success.

The Hidden Cost of Disconnected Operations and Finances

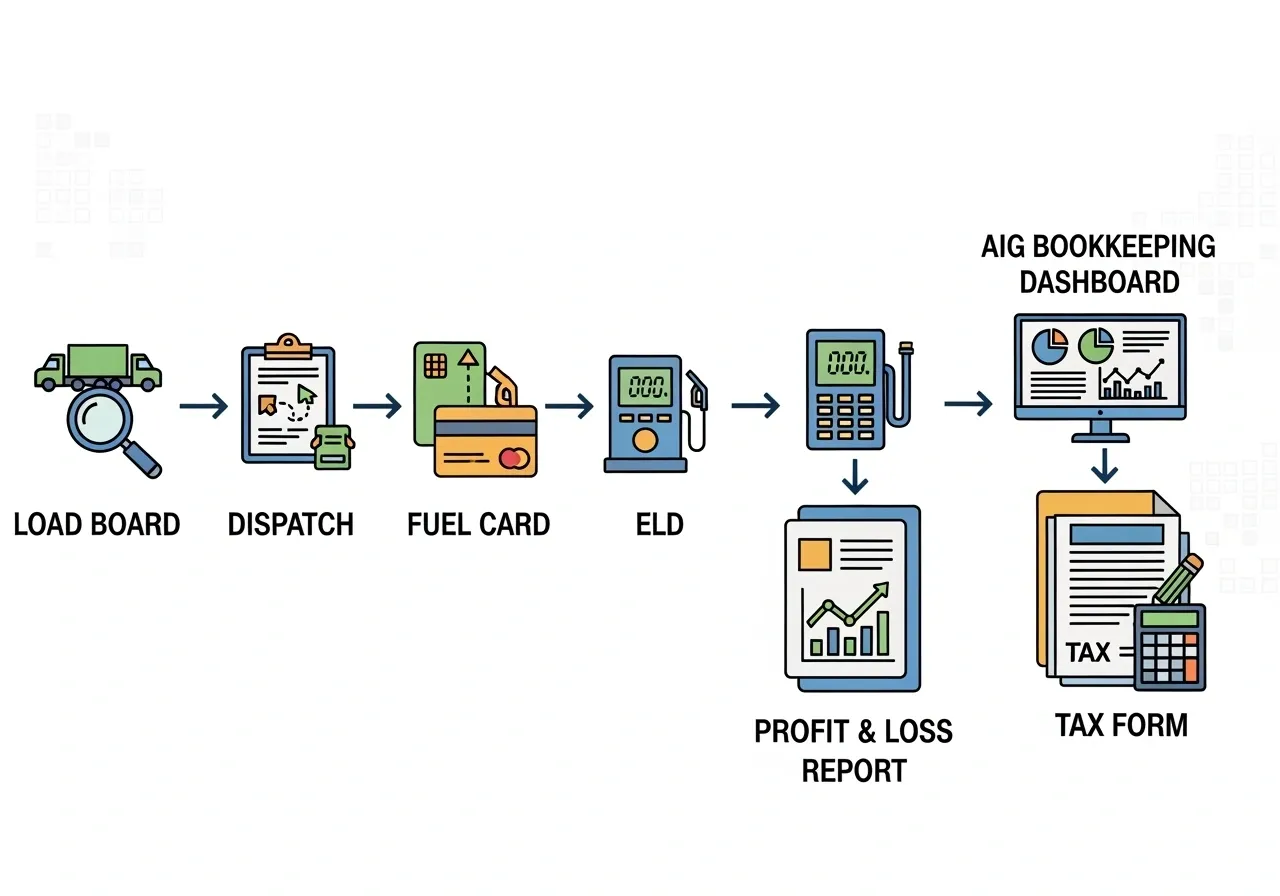

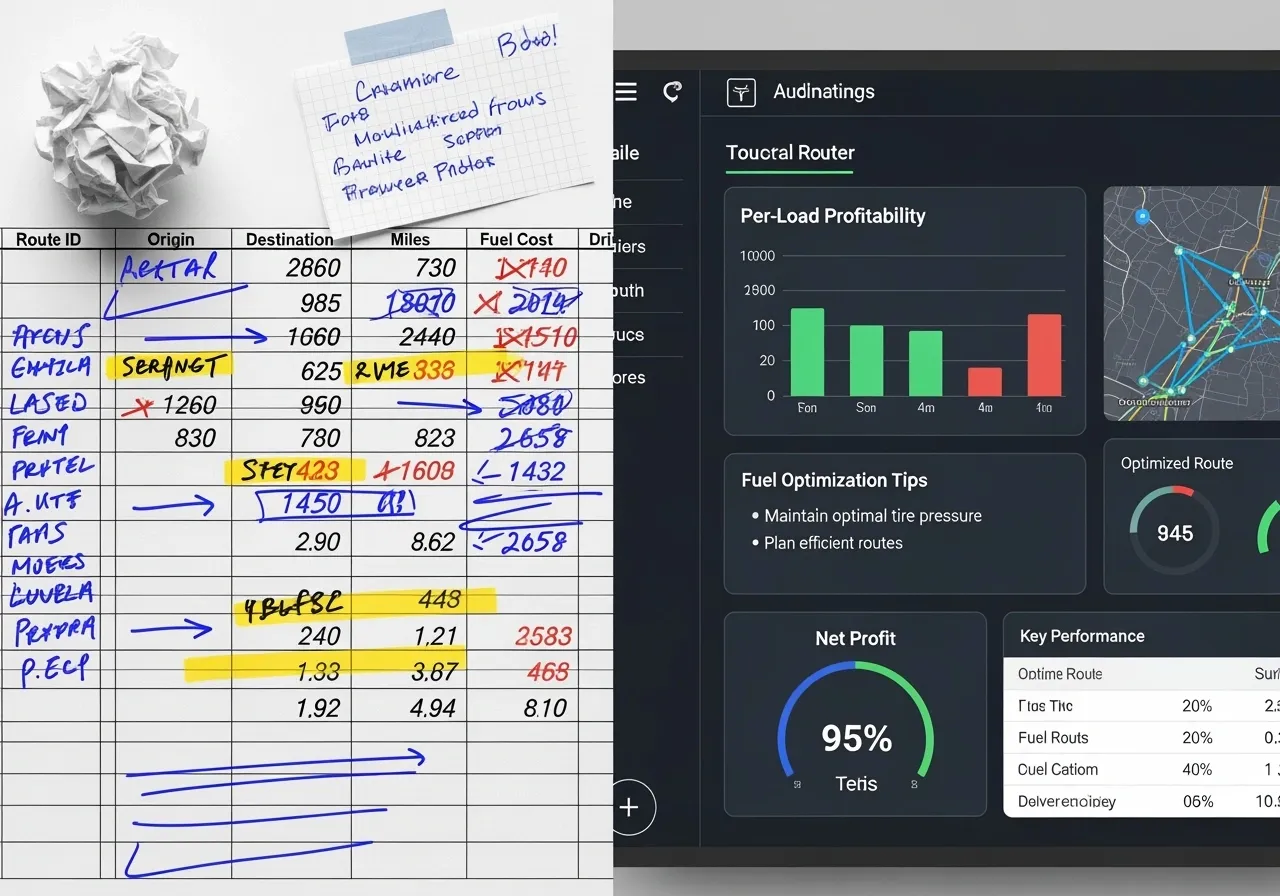

Most trucking operations run on a patchwork of different systems. You’ve got your ELD tracking hours and routes. Your fuel card manages purchases at the pump. Load boards help you find freight. Dispatch software coordinates pickups and deliveries. Each system serves its purpose perfectly – but they don’t talk to each other, and more importantly, they don’t talk to your books.

This disconnect creates what we call “financial blind spots” – critical gaps in understanding that can slowly bleed your business dry. Consider these common scenarios:

The Fuel Price Trap: You book a load when diesel is $3.20 per gallon, but by the time you’re halfway through your route, prices have jumped to $3.45. Your original profit calculation just went out the window, but you won’t know it until weeks later when you’re doing your monthly bookkeeping.

The Hidden Route Costs: That seemingly profitable run from Atlanta to Phoenix looks great at $2.80 per mile – until you factor in the $200 in tolls, the mandatory 34-hour reset that costs you two days of potential revenue, and the deadhead miles to get to your next load.

The Cash Flow Crunch: You’ve got $15,000 in outstanding invoices, but your fuel card bill is due tomorrow, truck payments are next week, and that major repair can’t wait. Traditional bookkeeping would show you’re profitable on paper, but your bank account tells a different story.

The Tax Time Surprise: Come April, your accountant hits you with a massive tax bill because nobody was tracking your quarterly obligations in real-time. Meanwhile, you’ve been missing out on thousands in legitimate deductions because your operational data wasn’t properly connected to your tax planning.

These aren’t isolated incidents – they’re systemic problems that plague the trucking industry because traditional bookkeeping treats trucking companies like any other business. But trucking isn’t like other businesses. Your office is a moving vehicle. Your inventory is time and miles. Your cash flow depends on factors that change by the hour.

How AIG Bridges the Operational-Financial Gap

At AIG Business Services LLC, we don’t just do your books – we integrate with your entire operation. Our approach starts with a simple principle: every operational decision should be an informed financial decision.

Here’s how we make that happen:

Real-Time System Integration: We don’t wait for you to hand us a shoebox full of receipts at the end of the month. Instead, we connect directly with your existing systems. Your ELD data flows automatically into our accounting platform. Fuel card transactions are imported and categorized in real-time. Load information from your dispatch software becomes part of your profit analysis before the wheels even start rolling.

Daily Reconciliation Process: While other bookkeeping services work on monthly cycles, we reconcile your accounts daily. This means you know exactly where you stand financially every single day, not just when you get your monthly statement.

Trucking-Specific Expertise: Our team doesn’t just understand accounting – we understand trucking. We know the difference between a reefer and a dry van, why detention time matters, and how seasonal freight patterns affect cash flow. This industry knowledge makes all the difference in how we categorize, analyze, and report your financial data.

From Load Selection to Real-Time Profit Analysis

Let’s revisit that Dallas to Denver load, but this time with AIG’s integrated approach:

Before you even book the load, our system analyzes:

- Current fuel prices along your route (updated hourly)

- Toll costs for your specific truck class and route

- Historical traffic patterns that might affect fuel consumption

- Your driver’s HOS status and potential delay costs

- Available backhaul opportunities from Denver

The moment you accept the load, we calculate:

- True cost per mile including all variable expenses

- Expected profit margin after all costs

- Impact on your weekly and monthly cash flow

- Tax implications of the revenue timing

Throughout the trip, we track:

- Actual vs. projected fuel consumption

- Real-time expense tracking through integrated fuel cards

- Route deviations and their cost impact

- Detention time and accessorial charges

Upon delivery, you receive:

- Complete profit analysis for the load

- Comparison to your projected numbers

- Recommendations for similar loads in the future

- Updated cash flow projections

This isn’t theoretical – it’s exactly what we do for our trucking clients every day. One owner-operator told us, “I thought I was making money on my regular lanes until AIG showed me the real numbers. Now I’m actually profitable, not just busy.”

Cash Flow Management That Matches Trucking Reality

Traditional businesses might wait 30 days for payment and that’s fine. In trucking, you might wait 30-90 days for payment while your expenses hit immediately. This creates unique cash flow challenges that require specialized solutions.

Factoring Integration and Analysis: If you use factoring, we integrate directly with your factoring company to track which invoices have been advanced, at what rate, and what the true cost of that financing is to your bottom line. We help you determine which loads are worth factoring and which ones you should wait for direct payment.

Predictive Cash Flow Modeling: Using your load schedule, payment terms, and historical data, we create rolling 90-day cash flow projections. This means you’ll know about potential cash crunches weeks before they happen, giving you time to take corrective action.

Expense Timing Optimization: We help you time major expenses and purchases to optimize both cash flow and tax benefits. Need new tires? We’ll tell you the best week to buy them. Considering a truck upgrade? We’ll model the financial impact across different scenarios.

Emergency Fund Management: We help you build and maintain appropriate cash reserves based on your specific operation. A long-haul owner-operator needs different reserves than a local delivery fleet, and we tailor our recommendations accordingly.

Tax Planning That Works with Trucking Operations

Tax planning for truckers isn’t just about keeping receipts – it’s about understanding how every operational decision affects your tax liability.

Per-Mile Depreciation Optimization: We track your actual business miles (not just total miles) and optimize your depreciation strategy accordingly. This includes coordinating Section 179 deductions, bonus depreciation, and regular depreciation to minimize your overall tax burden.

Route-Based Deduction Tracking: Your meal deductions aren’t just about keeping receipts – they’re about proving you were away from home for business purposes. We integrate your ELD data with your expense tracking to create bulletproof documentation for meal, lodging, and other travel deductions.

Multi-State Compliance Management: If you run interstate, you’re dealing with multiple tax jurisdictions. We handle IFTA reporting, state registration fees, and ensure you’re compliant with varying state tax requirements without overpaying.

Quarterly Tax Planning: Instead of getting hit with a massive tax bill in April, we calculate your quarterly obligations in real-time and help you set aside the right amount throughout the year. We also identify opportunities for equipment purchases or other tax-advantaged moves before year-end.

Technology Integration That Actually Works

We’ve invested heavily in technology that speaks the language of trucking operations:

ELD System Integration: We work with all major ELD providers including Samsara, KeepTruckin (now Motive), Omnitracs, and others. Your hours of service data becomes part of your cost analysis, helping you understand the true cost of regulatory compliance.

Load Board Connectivity: Whether you use DAT, Truckstop.com, 123LoadBoard, or others, we can integrate load data directly into your financial tracking. This means every load you book automatically becomes part of your profit analysis.

Fuel Card Management: We integrate with all major fuel card providers – Comdata, EFS, Fleet One, and others. Every fuel purchase is automatically categorized, tracked against your routes, and analyzed for efficiency opportunities.

Dispatch Software Integration: If you use TruckingOffice, ProTransport, or other dispatch software, we can connect directly to eliminate double data entry and ensure consistency between your operational and financial records.

24/7 Financial Dashboard Access: Because trucking doesn’t operate on banker’s hours, neither do we. Your financial dashboard is available 24/7, giving you real-time access to profit analysis, cash flow status, and key performance metrics whenever you need them.

Real Results from Real Trucking Operations

The proof is in the performance. Here’s what our trucking clients typically see within the first 90 days:

Improved Load Selection: By understanding true profitability per mile, clients typically increase their average profit margins by 10-15%. One client told us, “I was running 3,000 miles a week and barely breaking even. Now I run 2,500 miles and make 30% more profit.”

Better Cash Flow Management: With predictive cash flow modeling, clients avoid expensive emergency financing and late payment penalties. The average client saves $2,000-5,000 annually just in avoided fees and interest charges.

Optimized Tax Strategy: Our proactive tax planning typically saves clients 15-25% on their annual tax liability compared to reactive, year-end tax preparation.

Time Savings: Clients report saving 10-15 hours per week on administrative tasks, time they can reinvest in revenue-generating activities.

The AIG Advantage: Fixed Pricing That Makes Sense

Here’s what makes AIG different: we charge $265 per month, period. No hourly charges when you call with questions. No extra fees when we need to dig into a complex transaction. No retainers or setup costs. Just transparent, fixed pricing that lets you budget accurately.

This isn’t just about bookkeeping – it’s about having a complete financial operations partner who understands trucking. When you call us at 2 AM with a question about whether to take a load, we’re here. When you need cash flow analysis for a truck purchase, we’ve got the data ready. When tax season comes around, there are no surprises because we’ve been planning all year.

Your Next Step: See the Difference for Yourself

The gap between your operations and your books is costing you money every day. Every load you take without understanding true profitability, every cash flow crunch you don’t see coming, every tax opportunity you miss – it all adds up.

At AIG Business Services LLC, we’ve built our entire practice around solving these problems for trucking companies. We don’t just keep your books – we integrate with your operations to help you make better decisions, improve profitability, and build a sustainable business.

Ready to see how your loads really perform? Let’s talk. Schedule your free 30-minute discovery call today and we’ll show you exactly how we can connect your operations to your financial success.

Call us at +1-(833) 313-4996 or email finance@aigbiz.com. Because in trucking, the difference between being busy and being profitable often comes down to having the right financial partner who understands your business.

Your trucks are your livelihood. Your books should be your roadmap to success. Let AIG connect the two.

AIG Business Services LLC provides comprehensive financial services for transportation companies nationwide. Based in Sycamore, Georgia, we specialize in real-time bookkeeping, tax planning, and financial analysis for trucking operations of all sizes. Learn more at www.aigbiz.com.