While others struggle, data-driven trucking companies are turning crisis into opportunity through strategic financial management

Introduction: The Reality of the 2025 Freight Market

The freight industry is experiencing one of its most challenging periods in recent history. Spot rates have plummeted, fuel costs remain volatile, and many trucking companies are struggling to maintain profitability. Yet, some companies are not just surviving—they’re positioning themselves for growth when the market recovers.

At AIG Business Services, we’ve been working closely with trucking companies managing over $50 million in combined revenue throughout this downturn. What we’ve discovered is that the companies thriving in this recession share one critical advantage: superior financial visibility.

While their competitors operate on gut feelings and outdated reports, smart trucking companies are making data-driven decisions that preserve cash flow, optimize operations, and identify profitable opportunities others miss.

The harsh truth:This recession isn’t just testing operational efficiency—it’s exposing financial management weaknesses that have been hidden during better times.

The Current State of the Freight Recession

By the Numbers: The 2025 Freight Reality

Market Conditions:

- Spot rates down 25-40% from 2022 peaks

- Freight volumes decreased 15-20% year-over-year

- Diesel fuel costs averaging $4.20-$4.80 per gallon

- Driver shortage persisting despite slower demand

- Small carrier failures up 65% compared to 2023

The Survival Challenge:

- Operating margins compressed to 2-5% for many carriers

- Cash flow cycles extended due to customer payment delays

- Equipment financing becoming more restrictive

- Insurance costs continuing to rise despite reduced activity

Why Traditional Financial Management Fails in Recessions

Outdated Reporting:

- Monthly financial statements arrive too late for critical decisions

- Profit/loss reports don’t reflect real-time cash position

- Generic accounting misses trucking-specific metrics

Lack of Operational Integration:

- Financial data disconnected from dispatch decisions

- Route profitability unknown until after completion

- Driver performance impact on costs not tracked

Reactive Decision Making:

- Waiting for problems to appear in reports

- Making pricing decisions without current cost data

- Missing early warning signs of cash flow issues

The Financial Visibility Advantage

What Smart Trucking Companies Know

Companies surviving this recession have implemented comprehensive financial visibility systems that provide:

Real-Time Cash Flow Monitoring

- Daily cash position updates

- Accounts receivable aging with collection forecasts

- Fuel purchase timing optimization

- Payroll and expense timing management

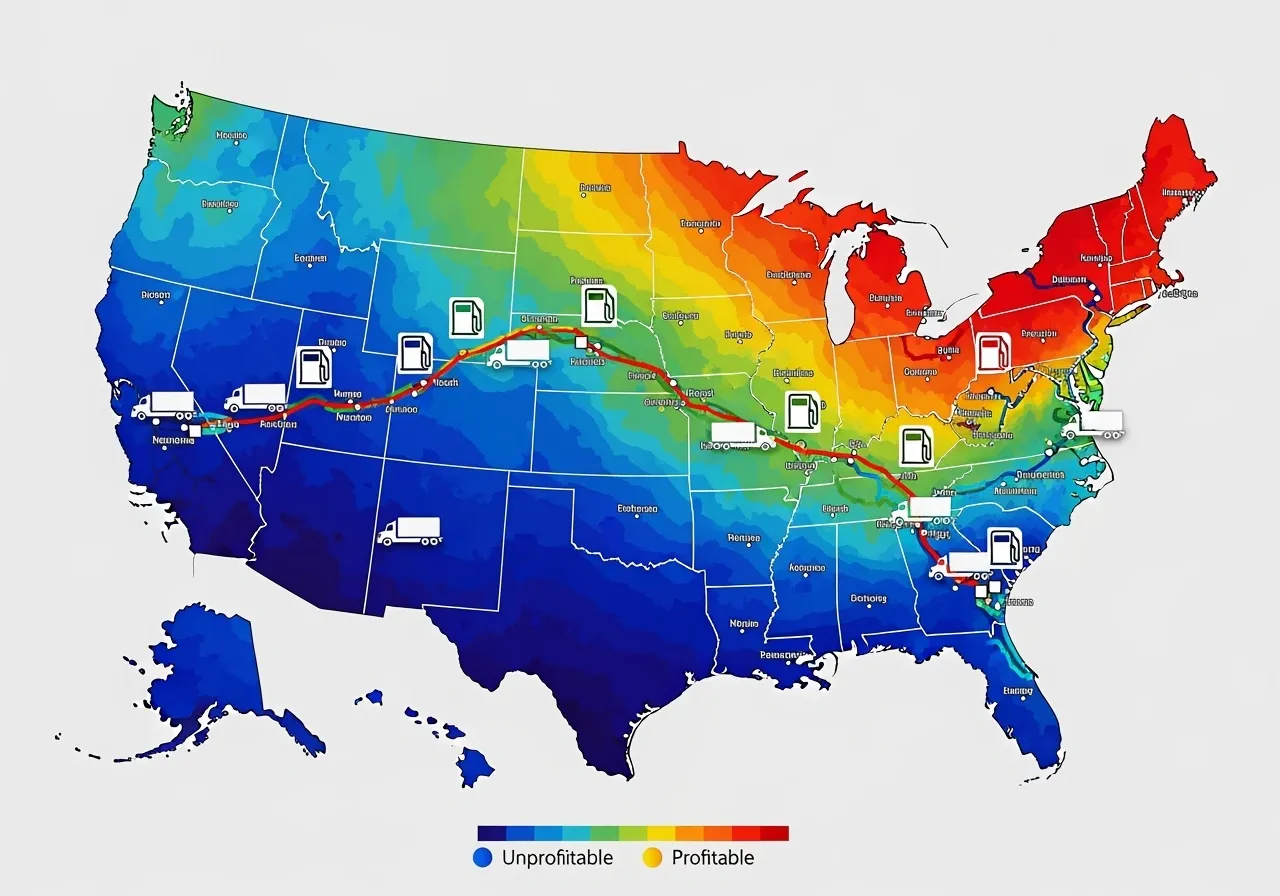

Route and Load Profitability Analysis

- Cost per mile calculations by truck and driver

- Customer profitability rankings

- Lane analysis for optimal routing

- Fuel efficiency tracking by route and driver

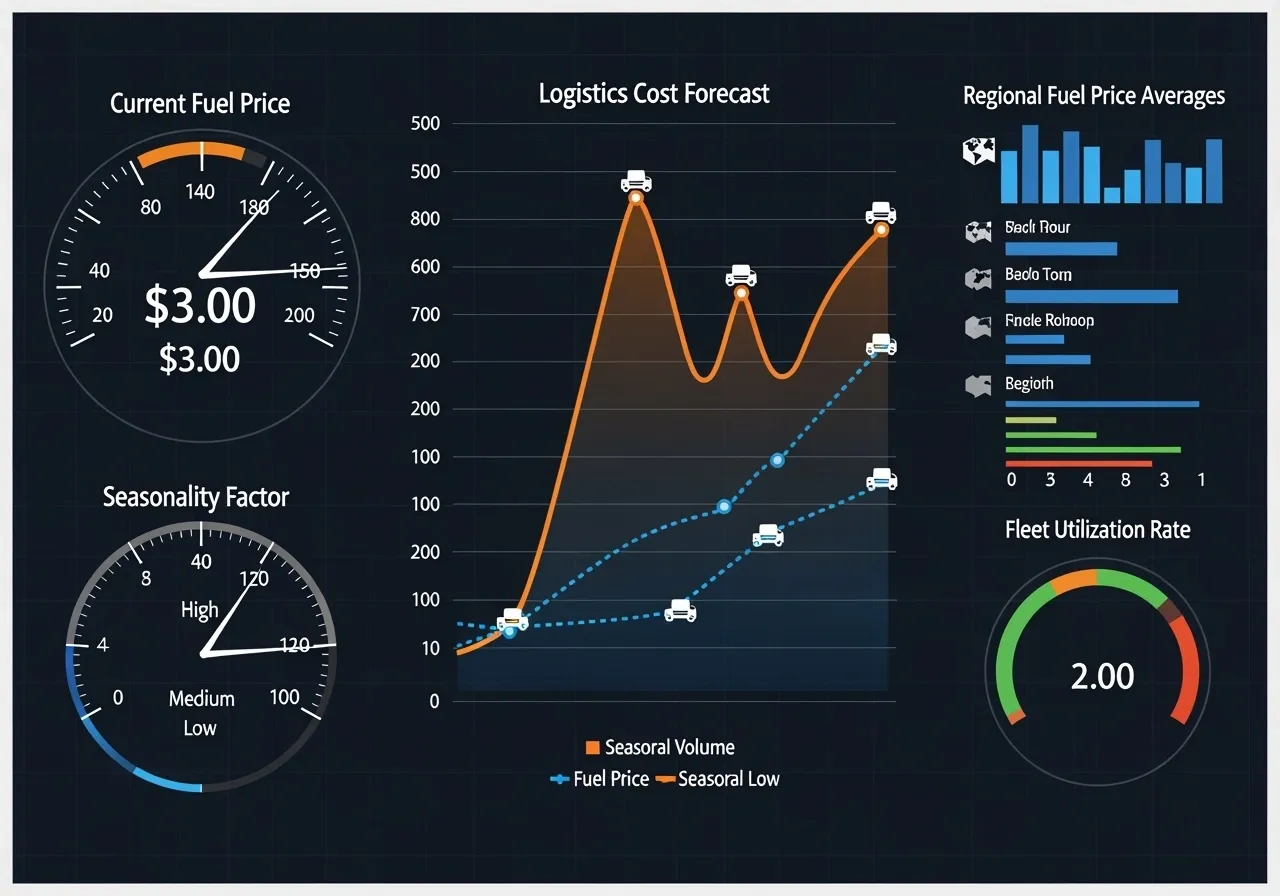

Predictive Financial Modeling

- 90-day cash flow forecasting

- Seasonal demand planning

- Fuel cost hedging strategies

- Equipment replacement timing

Survival Strategy #1: Master Your Cash Flow

The Challenge

Freight recessions create extended payment cycles while operating costs remain immediate. Companies without cash flow visibility often face sudden liquidity crises.

The Smart Company Approach

Daily Cash Flow Monitoring

- Track daily cash position and 30-day projections

- Monitor accounts receivable aging in real-time

- Identify slow-paying customers before they become problems

- Optimize payment timing for maximum cash preservation

Customer Payment Analysis

- Rank customers by payment speed and reliability

- Adjust credit terms based on payment history

- Implement early payment discounts for cash flow improvement

- Develop collection strategies for different customer types

Expense Timing Optimization

- Schedule major expenses during strong cash flow periods

- Negotiate payment terms with suppliers

- Time equipment purchases for maximum tax benefits

- Manage fuel purchases based on price forecasting

Real Success Story:One of our trucking clients improved their cash flow by 35% during the recession by implementing daily cash monitoring and adjusting their customer mix based on payment reliability data.

Implementation Steps

Week 1: Assessment

- Analyze current cash flow patterns

- Identify payment cycle bottlenecks

- Review customer payment histories

- Assess current reporting capabilities

Week 2-3: System Setup

- Implement daily cash flow reporting

- Create customer payment scorecards

- Establish cash flow forecasting models

- Set up automated alerts for critical thresholds

Week 4+: Optimization

- Adjust customer credit terms based on data

- Optimize expense timing

- Implement collection improvement strategies

- Regular review and refinement

Survival Strategy #2: Optimize Route and Load Profitability

The Challenge

In tight margin environments, unprofitable loads can quickly drain resources. Many trucking companies don’t know which routes, customers, or drivers are actually profitable.

The Smart Company Approach

Comprehensive Cost Analysis

- Calculate true cost per mile including all variables

- Track fuel efficiency by driver and route

- Monitor maintenance costs by truck and route type

- Include driver wages, benefits, and productivity metrics

Customer Profitability Ranking

- Analyze total customer value including payment terms

- Factor in loading/unloading time and efficiency

- Consider fuel costs and deadhead miles

- Evaluate long-term relationship value

Route Optimization

- Identify most profitable lanes and focus resources

- Eliminate or reprice unprofitable routes

- Optimize backhaul opportunities

- Reduce deadhead miles through better planning

Driver Performance Integration

- Track fuel efficiency by individual driver

- Monitor on-time delivery rates

- Analyze maintenance costs by driving habits

- Implement performance-based incentives

Real Results

A regional carrier we work with discovered that 30% of their routes were unprofitable. By eliminating these routes and focusing on profitable lanes, they increased overall profitability by 28% despite 15% lower revenue.

Survival Strategy #3: Predictive Financial Planning

The Challenge

Reactive financial management leads to crisis decisions. Smart companies use predictive modeling to anticipate challenges and opportunities.

The Smart Company Approach

90-Day Rolling Forecasts

- Predict cash flow based on current contracts and trends

- Model different scenarios (best case, worst case, most likely)

- Plan for seasonal variations and market changes

- Adjust operations based on financial projections

Fuel Cost Management

- Track fuel price trends and forecasting

- Optimize fuel purchasing timing

- Implement fuel surcharge strategies

- Consider hedging for large operations

Equipment and Maintenance Planning

- Schedule maintenance during slow periods

- Plan equipment replacements based on total cost analysis

- Optimize financing timing for tax benefits

- Prepare for post-recession equipment needs

Market Recovery Positioning

- Maintain financial reserves for growth opportunities

- Identify acquisition targets during market weakness

- Prepare for driver recruitment when demand returns

- Plan capacity expansion for market recovery

Technology Solutions for Financial Visibility

Essential Tools for Trucking Financial Management

Real-Time Financial Reporting

- Cloud-based accounting systems with trucking-specific features

- Integration with dispatch and fleet management systems

- Mobile access for real-time decision making

- Automated report generation and alerts

Cash Flow Management Tools

- Automated accounts receivable tracking

- Payment prediction algorithms

- Cash flow forecasting models

- Integration with banking systems

Profitability Analysis Software

- Route and load profitability calculators

- Customer profitability ranking systems

- Driver performance tracking

- Fuel efficiency monitoring

Predictive Analytics

- Market trend analysis tools

- Seasonal demand forecasting

- Fuel price prediction models

- Equipment replacement planning

AIG’s Integrated Approach

Our $265/Month Bookkeeping Service Includes:

- Real-time financial reporting specific to trucking operations

- Daily cash flow monitoring and forecasting

- Route and customer profitability analysis

- Integration with popular trucking software systems

- No retainers or extra hour charges

- 24/7 support included

Business Coaching for Strategic Planning:

- Recession survival strategy development

- Market recovery positioning

- Growth planning and financing strategies

- Performance optimization consulting

Case Study: Recession Success Story

The Situation

A mid-sized trucking company with 25 trucks was struggling in early 2024. Revenue was down 20%, margins were compressed, and cash flow was becoming critical.

The Financial Visibility Implementation

Month 1: Assessment and Setup

- Implemented real-time financial reporting

- Analyzed historical route and customer profitability

- Established daily cash flow monitoring

- Created 90-day financial forecasting model

Month 2-3: Optimization

- Eliminated 40% of unprofitable routes

- Renegotiated terms with slow-paying customers

- Optimized fuel purchasing and maintenance scheduling

- Implemented driver performance incentives

Month 4-6: Strategic Positioning

- Focused on most profitable customers and lanes

- Built cash reserves for market recovery

- Planned equipment upgrades for efficiency

- Developed growth strategy for market upturn

The Results

- Cash Flow: Improved by 45% despite 15% revenue reduction

- Profitability: Increased margins from 3% to 8%

- Efficiency: Reduced cost per mile by 12%

- Positioning: Built 6-month cash reserve for growth opportunities

CEO Quote: “The financial visibility system didn’t just help us survive the recession—it positioned us to dominate when the market recovers. We’re making decisions based on data, not desperation.”

Preparing for Market Recovery

Smart Companies Are Already Planning

Financial Positioning

- Building cash reserves for growth opportunities

- Maintaining strong credit relationships

- Preparing for equipment financing needs

- Planning for driver recruitment and retention

Operational Optimization

- Streamlining operations for maximum efficiency

- Investing in technology for competitive advantage

- Developing customer relationships for recovery growth

- Preparing for capacity expansion

Strategic Opportunities

- Identifying acquisition targets

- Developing new service offerings

- Expanding into profitable markets

- Building partnerships for growth

The Recovery Advantage

Companies with superior financial visibility will be positioned to:

- Quickly identify market recovery signals

- Rapidly scale operations when demand returns

- Acquire distressed competitors at favorable terms

- Capture market share from failed competitors

The AIG Advantage for Trucking Companies

Why Trucking Companies Choose AIG During Recessions

Industry Expertise

- Deep understanding of trucking operations and challenges

- Experience with freight market cycles and recovery patterns

- Knowledge of trucking-specific financial metrics and KPIs

- Proven track record with transportation companies

Comprehensive Financial Services

- Real-Time Bookkeeping: $265/month fixed pricing with trucking-specific reporting

- Financial Coaching: Strategic guidance for recession survival and growth

- Cash Flow Management: Daily monitoring and optimization strategies

- Tax Planning: Minimize tax burden while maintaining compliance

- 24/7 Support: Available for critical financial decisions

Proven Results During Downturns

- $50+ Million in trucking revenue managed through market cycles

- 90% Client Retention Rate even during challenging periods

- 35% Average Cash Flow Improvement within 90 days

- 5+ Years average client relationship duration

Our Recession Survival Process

Phase 1: Financial Health Assessment (Week 1)

- Comprehensive analysis of current financial position

- Cash flow and profitability evaluation

- Risk assessment and opportunity identification

- Custom survival strategy development

Phase 2: System Implementation (Weeks 2-4)

- Real-time financial reporting setup

- Cash flow monitoring and forecasting

- Route and customer profitability analysis

- Performance tracking and optimization

Phase 3: Strategic Optimization (Ongoing)

- Monthly financial reviews and adjustments

- Quarterly strategic planning sessions

- Market recovery positioning

- Growth opportunity identification

Industries We Serve Beyond Trucking

While we specialize in trucking and transportation, our expertise extends to:

- Moving & Relocation – Seasonal planning and capacity management

- eCommerce – Inventory management and marketplace optimization

- SaaS – Customer acquisition and retention strategies

- Marketing Agencies – Client acquisition and service scaling

- Real Estate – Deal flow optimization and team building

- Insurance Agents – Lead generation and conversion improvement

- Plumbing & HVAC – Systematization and growth strategies

- Restaurants – Cost management and operational efficiency

Take Action: Survive and Thrive in the Freight Recession

The 2025 freight recession will separate the survivors from the casualties. Companies with superior financial visibility aren’t just weathering the storm—they’re positioning themselves for dominance when the market recovers.

Ready to Transform Your Financial Visibility?

Schedule Your Free Recession Survival Assessment

- Comprehensive financial health evaluation

- Cash flow optimization recommendations

- Route and customer profitability analysis

- Custom recession survival strategy

- No-obligation consultation

Contact AIG Business Services:

- Phone: +1-(833) 313-4996

- Email: finance@aigbiz.com

- Website: aigbiz.com

- Location: Sycamore, Georgia (Serving Nationwide)

What You’ll Discover:

- Hidden cash flow opportunities in your current operations

- Unprofitable routes and customers draining your resources

- Specific strategies to improve margins during the recession

- How to position your company for market recovery growth

- Integration opportunities with our $265/month bookkeeping services

Why Act Now:

- Every day without financial visibility costs money

- Early action provides maximum recession survival benefit

- Market recovery preparation requires advance planning

- Limited availability for new trucking clients during high-demand period

Frequently Asked Questions

Q: How quickly can you implement financial visibility systems? A: Most trucking companies see initial improvements within 2-3 weeks of implementation, with full system optimization typically achieved within 60 days.

Q: What’s included in your $265/month bookkeeping service? A: Real-time financial reporting, daily cash flow monitoring, route profitability analysis, accounts receivable management, and 24/7 support—all with no retainers or extra hour charges.

Q: Can you work with our existing trucking software? A: Yes, we integrate with popular trucking management systems including dispatch software, fleet management tools, and fuel card systems.

Q: How do you help with recession-specific challenges? A: We provide cash flow optimization, customer payment analysis, route profitability assessment, and strategic planning for market recovery.

Q: What makes you different from other accounting firms? A: We specialize in trucking and transportation, offer fixed pricing with no surprises, provide 24/7 support, and combine bookkeeping with strategic business coaching.

Conclusion: Turn Crisis Into Competitive Advantage

The 2025 freight recession isn’t just a challenge—it’s an opportunity for smart trucking companies to gain permanent competitive advantages.

While competitors struggle with outdated financial management, companies with superior financial visibility are making data-driven decisions that preserve cash, optimize operations, and position for growth.

The companies that will dominate post-recession trucking are being built today through:

- Real-time financial visibility and decision-making

- Strategic cash flow management and optimization

- Route and customer profitability optimization

- Predictive planning for market recovery

The choice is clear:Continue operating blind and risk becoming a recession casualty, or implement financial visibility systems that turn crisis into competitive advantage.

Your recession survival and market recovery success starts with financial visibility. Let’s build it together.

AIG Business Services LLC specializes in financial services for trucking and transportation companies. Based in Sycamore, Georgia, and serving businesses nationwide, we provide bookkeeping, accounting, tax services, and business coaching with transparent, fixed pricing starting at $265/month. With over $50 million in client revenue managed and a 90% retention rate, we help trucking companies survive recessions and thrive during recoveries through superior financial visibility and strategic planning. Contact us at (833) 313-4996 or finance@aigbiz.com for your free consultation.

Ready to transform your trucking company’s financial visibility? Schedule your free recession survival assessment today and discover how data-driven decision making can turn the 2025 freight recession into your competitive advantage.