The Software as a Service (SaaS) industry has revolutionized how businesses operate, but managing SaaS finances requires a fundamentally different approach than traditional business models. With recurring revenue streams, subscription-based pricing, and unique customer lifecycle patterns, SaaS companies need specialized financial management strategies. At AIG Business Services, we’ve helped numerous SaaS companies navigate these complexities with our fixed-price bookkeeping services, ensuring they track the metrics that truly drive growth and profitability.

Understanding the SaaS Financial Landscape SaaS businesses operate on fundamentally different financial principles than traditional companies. Instead of one-time transactions, SaaS companies build recurring revenue relationships with customers. This model creates unique opportunities and challenges that require specialized financial tracking and analysis. The key to success lies in understanding which metrics actually predict future performance and focusing your financial management efforts on those critical indicators.

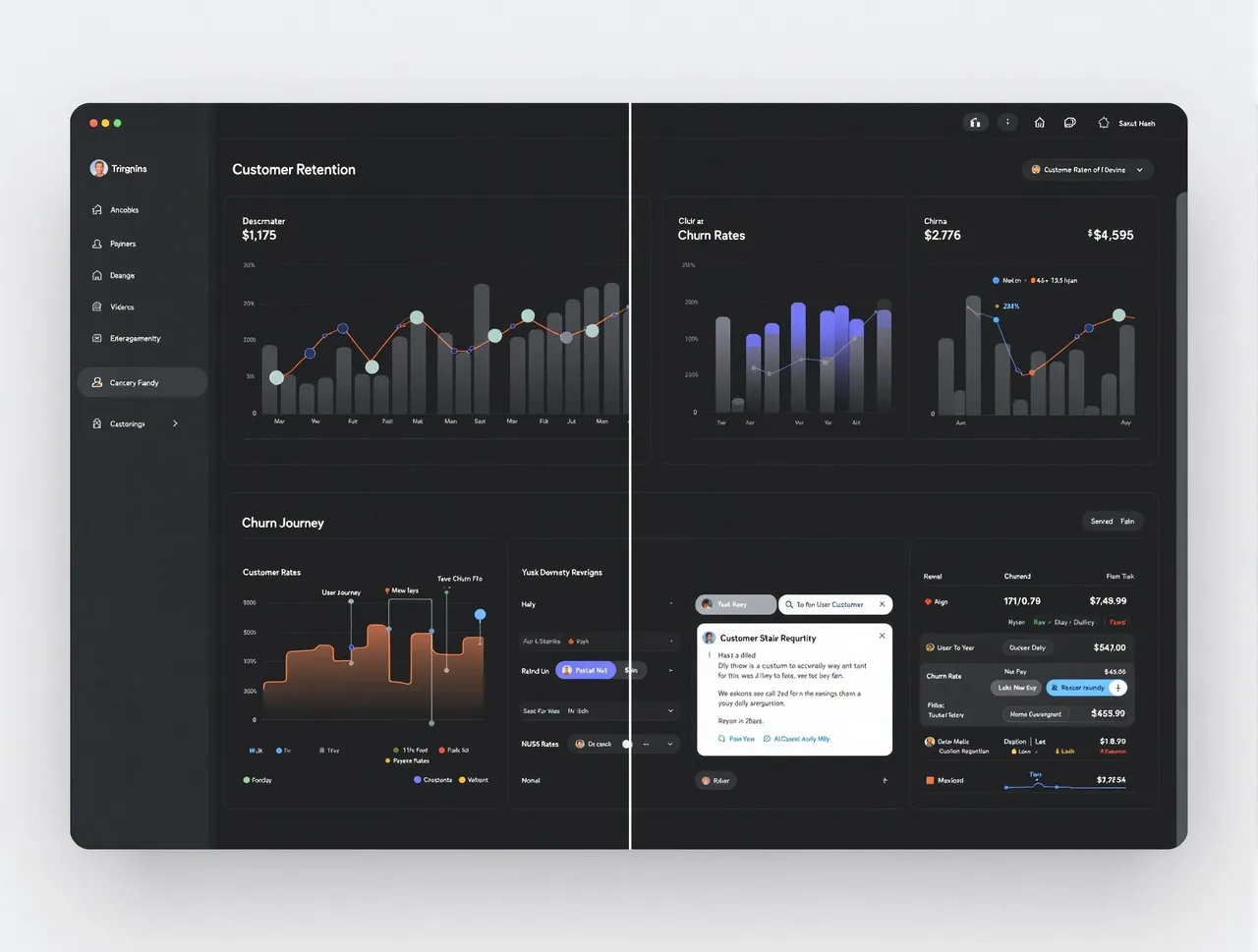

Monthly Recurring Revenue (MRR): Your North Star Metric Monthly Recurring Revenue remains the most crucial metric for any SaaS business. MRR represents the predictable revenue stream that forms the foundation of your business model. However, simply tracking total MRR isn’t enough in 2025. You need to break down MRR into its component parts: new MRR from new customers, expansion MRR from existing customers upgrading their plans, and churned MRR from customers who cancel or downgrade. This granular view helps you understand exactly where your growth is coming from and where you might be losing ground.

Tracking MRR trends over time reveals patterns that can inform strategic decisions. Seasonal fluctuations, the impact of marketing campaigns, and the effects of product changes all become visible through careful MRR analysis. At AIG Business Services, we help SaaS companies implement robust MRR tracking systems that provide real-time visibility into revenue performance.

Annual Recurring Revenue (ARR): The Big Picture View While MRR provides monthly insights, Annual Recurring Revenue gives you the strategic perspective needed for long-term planning. ARR helps with investor communications, strategic planning, and understanding your business’s overall trajectory. In 2025, sophisticated SaaS companies track both committed ARR (contracted revenue) and projected ARR (including expected renewals and expansions).

Customer Acquisition Cost (CAC): Measuring Growth Efficiency Customer Acquisition Cost has evolved beyond simple marketing spend divided by new customers. Modern CAC calculations include sales team costs, marketing technology expenses, content creation costs, and even a portion of product development expenses related to customer-facing features. Understanding your fully-loaded CAC helps you make informed decisions about scaling your customer acquisition efforts.

The key insight comes from tracking CAC trends across different customer segments and acquisition channels. What works for enterprise customers might be completely different from small business acquisition strategies. This segmented approach to CAC analysis helps optimize your marketing and sales investments for maximum return.

Customer Lifetime Value (CLV): Predicting Long-term Success Customer Lifetime Value calculations have become more sophisticated in 2025, incorporating factors like expansion revenue, referral value, and even the cost savings from customer success activities. The traditional CLV formula of average revenue per customer multiplied by customer lifespan no longer captures the full picture for modern SaaS businesses.

Advanced CLV models consider the probability of expansion, the likelihood of referrals, and the varying value of different customer segments. This nuanced approach helps SaaS companies make better decisions about customer acquisition spending and retention investments.

Churn Rate: Beyond Simple Cancellations Churn analysis has evolved to include multiple dimensions: logo churn (customers leaving), revenue churn (including downgrades), and net revenue churn (accounting for expansions). Understanding these different types of churn helps identify specific areas for improvement in your customer success efforts.

Cohort-based churn analysis reveals patterns that aggregate churn rates might miss. Customers acquired during certain periods, through specific channels, or with particular characteristics might have different churn patterns. This insight helps refine both acquisition and retention strategies.

Gross Revenue Retention and Net Revenue Retention These metrics have become essential for understanding the health of your existing customer base. Gross Revenue Retention measures how well you retain revenue from existing customers, while Net Revenue Retention includes the impact of expansions and upsells. World-class SaaS companies achieve Net Revenue Retention rates above 110%, meaning their existing customer base grows in value over time.

Cash Flow Management for SaaS SaaS cash flow management requires understanding the timing differences between customer acquisition costs (paid upfront) and revenue recognition (spread over time). This creates unique cash flow challenges, especially for rapidly growing companies. Effective cash flow forecasting for SaaS businesses must account for seasonal patterns, payment terms, and the lag between sales and cash collection.

Unit Economics: The Foundation of Sustainable Growth Unit economics analysis helps determine whether your business model is fundamentally sound. The key ratios include CLV to CAC ratio (should be at least 3:1), CAC payback period (ideally under 12 months), and gross margin per customer. These metrics help identify whether growth is sustainable or if you’re buying revenue at unsustainable costs.

Financial Planning and Analysis (FP&A) for SaaS Modern SaaS FP&A goes beyond traditional budgeting to include scenario planning, sensitivity analysis, and dynamic forecasting. With the subscription model’s inherent predictability, SaaS companies can create more accurate forecasts than traditional businesses. However, this requires sophisticated modeling that accounts for cohort behavior, seasonal patterns, and market dynamics.

Technology Stack for SaaS Financial Management The right technology stack is crucial for effective SaaS financial management. This includes subscription billing platforms, revenue recognition software, customer success tools, and financial reporting systems. Integration between these systems ensures data consistency and enables comprehensive analysis.

Compliance and Revenue Recognition SaaS companies must navigate complex revenue recognition rules, particularly ASC 606. Proper implementation requires understanding contract terms, performance obligations, and timing of revenue recognition. This complexity makes professional financial management even more valuable for SaaS companies.

Investor Metrics and Reporting SaaS companies often need to report specialized metrics to investors, including Rule of 40 (growth rate plus profit margin), magic number (sales efficiency), and various efficiency ratios. Consistent, accurate reporting of these metrics builds investor confidence and supports fundraising efforts.

Scaling Financial Operations as SaaS companies grow, their financial operations must scale accordingly. This includes implementing proper controls, establishing approval processes, and creating reporting systems that support decision-making at scale. Many growing SaaS companies benefit from outsourced financial management that provides expertise without the overhead of a full finance team.

The AIG Advantage for SaaS Companies at AIG Business Services, we understand the unique challenges facing SaaS companies. Our fixed-price bookkeeping service at $265/month provides the specialized expertise SaaS companies need without the uncertainty of hourly billing. We help SaaS companies implement proper revenue recognition, track key metrics, and maintain the financial discipline needed for sustainable growth.

Conclusion: Effective SaaS financial management in 2025 requires understanding and tracking the metrics that truly matter for your business model. From MRR and churn analysis to unit economics and cash flow forecasting, each metric provides crucial insights for decision-making. With the right financial management partner, SaaS companies can focus on growth while maintaining the financial discipline needed for long-term success.

Ready to optimize your SaaS financial management? Contact AIG Business Services today at +1-(833) 313-4996 or email finance@aigbiz.com to schedule your free 30-minute discovery call. Let us show you how our specialized SaaS expertise can help your business thrive.