Running a moving company in 2025 means juggling countless responsibilities – from managing crews and coordinating logistics to ensuring customer satisfaction and maintaining equipment. The last thing you need is the added complexity of managing multiple financial service providers for your bookkeeping, payroll, and tax needs. At AIG Business Services LLC, we understand the unique challenges facing moving companies, which is why we’ve created a comprehensive financial package that puts all your essential services under one roof at a truly fixed price of $265/month.

The Hidden Costs of Fragmented Financial Services

Most moving companies make the mistake of working with separate providers for their financial needs – one company for bookkeeping, another for payroll, and yet another for tax services. This fragmented approach creates numerous problems that drain both time and money from your operation.

Consider the typical scenario: You’re spending hours each week coordinating between your bookkeeper, payroll company, and tax preparer. Information gets lost in translation, deadlines are missed because one provider doesn’t communicate with another, and you’re constantly explaining your business model to different people who don’t understand the moving industry’s unique requirements.

The financial impact is even more significant. Multiple service providers mean multiple bills, often with unpredictable pricing structures. Your bookkeeper charges by the hour, your payroll company has hidden fees, and your tax preparer surprises you with additional charges for “complex” returns. Before you know it, you’re paying $500, $700, or even $1,000+ monthly for financial services that should work together seamlessly.

AIG’s Integrated Approach: Everything You Need, Nothing You Don’t

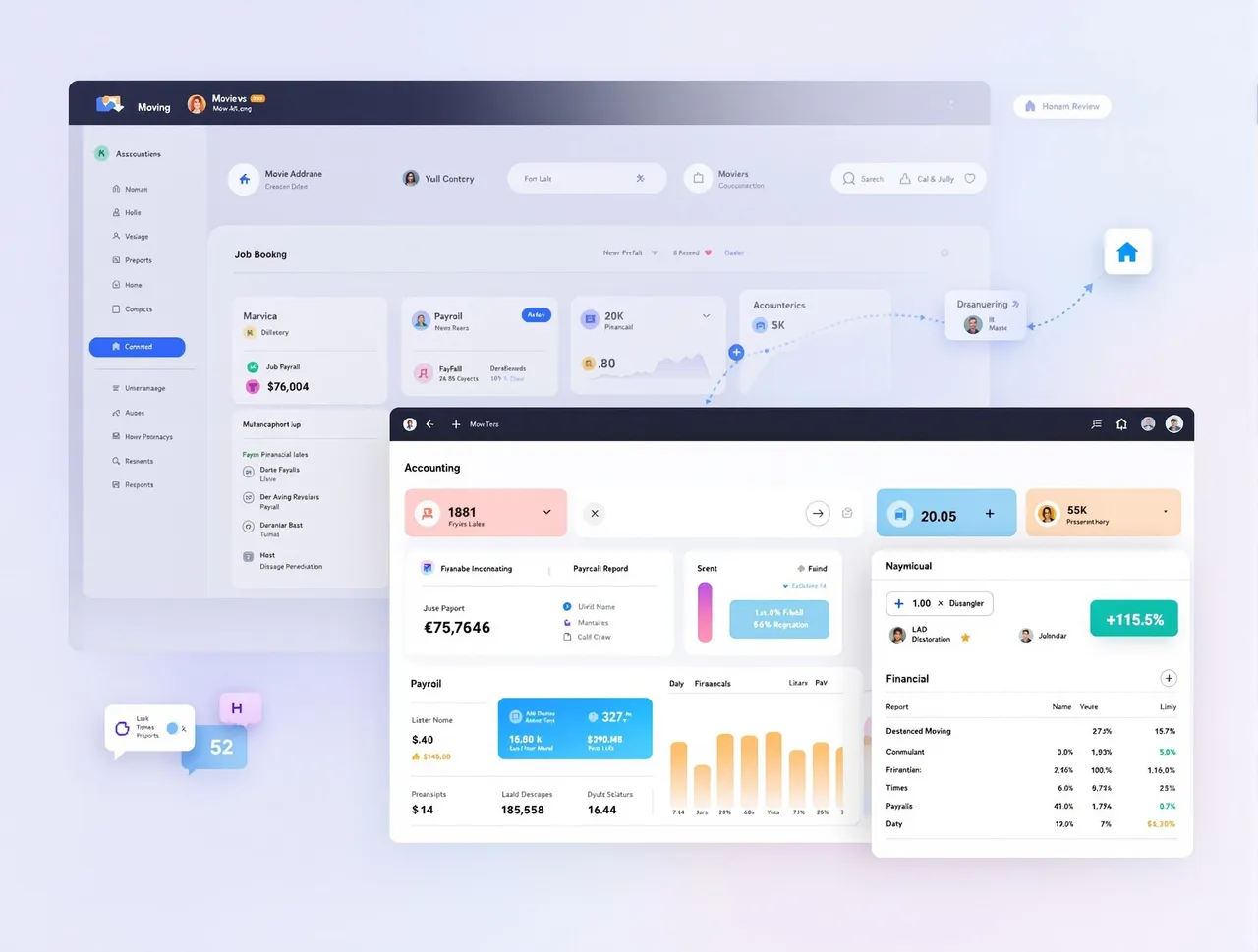

At AIG Business Services, we’ve revolutionized financial management for moving companies by offering a complete package of essential services at one transparent price. Our $265/month fixed pricing includes bookkeeping, accounting, tax services, payroll support, and financial reporting – everything your moving company needs to maintain healthy finances and regulatory compliance.

This integrated approach means your financial data flows seamlessly between all services. Your payroll information automatically integrates with your bookkeeping records, your tax planning considers your complete financial picture, and your financial reports provide comprehensive insights across all aspects of your business.

Comprehensive Bookkeeping Tailored for Moving Companies

Our bookkeeping services go far beyond basic transaction recording. We understand the unique aspects of the moving industry – from handling deposits and final payments to managing inventory for packing supplies and tracking vehicle-specific expenses. Our team categorizes your transactions in ways that make sense for your business, ensuring you always have clear visibility into your profitability.

We handle both cash and accrual accounting methods, depending on your business needs and size. For growing moving companies, we often recommend accrual accounting to provide better insights into your true financial performance, especially when dealing with jobs that span multiple weeks or months.

Our real-time financial reporting means you always know where your business stands. Instead of waiting until month-end to see your financial position, you can access up-to-date profit and loss statements, cash flow reports, and balance sheets whenever you need them. This real-time visibility is crucial for making informed decisions about pricing, capacity, and growth opportunities.

Payroll Support That Understands Your Industry

Moving companies face unique payroll challenges that generic payroll services often struggle to handle effectively. Your crew might work different hours each day, you may have seasonal employees, and you need to track various types of compensation – hourly wages, piece rates for certain jobs, overtime calculations, and performance bonuses.

Our payroll support service integrates seamlessly with your bookkeeping, ensuring accurate recording of all labor costs. We help you navigate complex issues like worker classification (employee vs. contractor), overtime regulations, and state-specific requirements when your crews work across state lines.

We also assist with payroll tax compliance, ensuring all federal, state, and local taxes are calculated correctly and filed on time. This includes managing unemployment insurance, workers’ compensation reporting, and other payroll-related obligations that can create significant problems if handled incorrectly.

Tax Services Designed for Moving Company Success

Tax planning and preparation for moving companies requires specialized knowledge of industry-specific deductions and regulations. Our tax services team understands the unique aspects of your business, from vehicle depreciation strategies to proper handling of customer reimbursements and damage claims.

We help you maximize legitimate deductions for fuel costs, vehicle maintenance, equipment purchases, and business-related travel. For interstate moving companies, we navigate the complex world of multi-state tax obligations, ensuring compliance while minimizing your overall tax burden.

Our year-round tax planning approach means we’re constantly looking for opportunities to optimize your tax position. Rather than simply preparing returns at year-end, we provide ongoing guidance to help you make tax-smart decisions throughout the year.

Financial Reporting That Drives Better Decisions

Our comprehensive financial reporting goes beyond basic profit and loss statements. We provide moving company-specific reports that help you understand your business performance at a granular level. This includes profitability analysis by job type, crew productivity reports, and vehicle utilization metrics.

These reports help you identify trends and opportunities that might otherwise go unnoticed. For example, you might discover that certain types of moves are significantly more profitable than others, or that specific crews consistently outperform expectations. This insight allows you to adjust your pricing, marketing, and operational strategies for maximum profitability.

The Time-Saving Benefits of Integration

When all your financial services work together seamlessly, the time savings are substantial. Instead of spending hours each week coordinating between different providers, you have one point of contact for all your financial needs. This means fewer phone calls, fewer emails, and fewer meetings to discuss your financial situation.

Our clients typically report saving 5-10 hours per week after switching to our integrated approach. For a moving company owner, that’s time that can be spent on growing the business, improving operations, or simply achieving better work-life balance.

The integration also eliminates the need to explain your business repeatedly to different service providers. Our team understands your operation comprehensively, which means faster responses to questions and more relevant advice for your specific situation.

Technology Integration for Seamless Operations

Our technology platform integrates with the tools you already use to run your moving business. Whether you’re using specialized moving software for job management or simple tools for scheduling and customer communication, we can connect our financial systems to minimize data entry and ensure accuracy.

This integration means your job information automatically flows into your financial records, your crew time tracking connects to payroll processing, and your customer payments are recorded immediately in your books. The result is more accurate financial data with less manual work.

24/7 Support When You Need It

Moving companies don’t operate on traditional business hours, and neither do we. Our 24/7 support ensures you can get answers to financial questions whenever they arise. Whether you need to understand a report at 6 AM before a big job or have questions about a tax issue on the weekend, our team is available to help.

This round-the-clock availability is particularly valuable during peak moving season when every hour counts and financial questions can’t wait until Monday morning.

Industry Expertise That Makes a Difference

Our team has extensive experience working with moving and relocation companies across the United States. We understand the seasonal nature of your business, the regulatory requirements you face, and the financial challenges specific to your industry.

This expertise means we can provide relevant advice and catch potential issues before they become problems. We know which expenses are deductible for moving companies, how to handle interstate tax obligations, and what financial metrics matter most for your type of business.

Getting Started with AIG Business Services

Transitioning to our comprehensive financial package is straightforward and designed to minimize disruption to your operations. We handle the setup process, coordinate with your previous providers to ensure smooth data transfer, and provide training on our reporting systems.

Most moving companies are fully operational with our integrated services within two weeks of signing up. During the transition period, we provide extra support to ensure nothing falls through the cracks and all your financial obligations continue to be met on time.

The AIG Advantage: Transparency and Reliability

What truly sets AIG Business Services apart is our commitment to transparency and reliability. Our $265/month fixed pricing means you always know what you’ll pay – no matter how complex your business becomes or how many transactions you process. We don’t charge extra for phone calls, additional reports, or seasonal volume increases.

This predictable pricing makes budgeting easier and eliminates the financial surprises that can disrupt your cash flow planning. You can focus on growing your moving business knowing that your financial management costs will remain stable and affordable.

Ready to Simplify Your Financial Management?

Don’t let fragmented financial services hold your moving company back. Our comprehensive package provides everything you need to maintain healthy finances, ensure compliance, and make informed business decisions – all at a price that makes sense for your business.