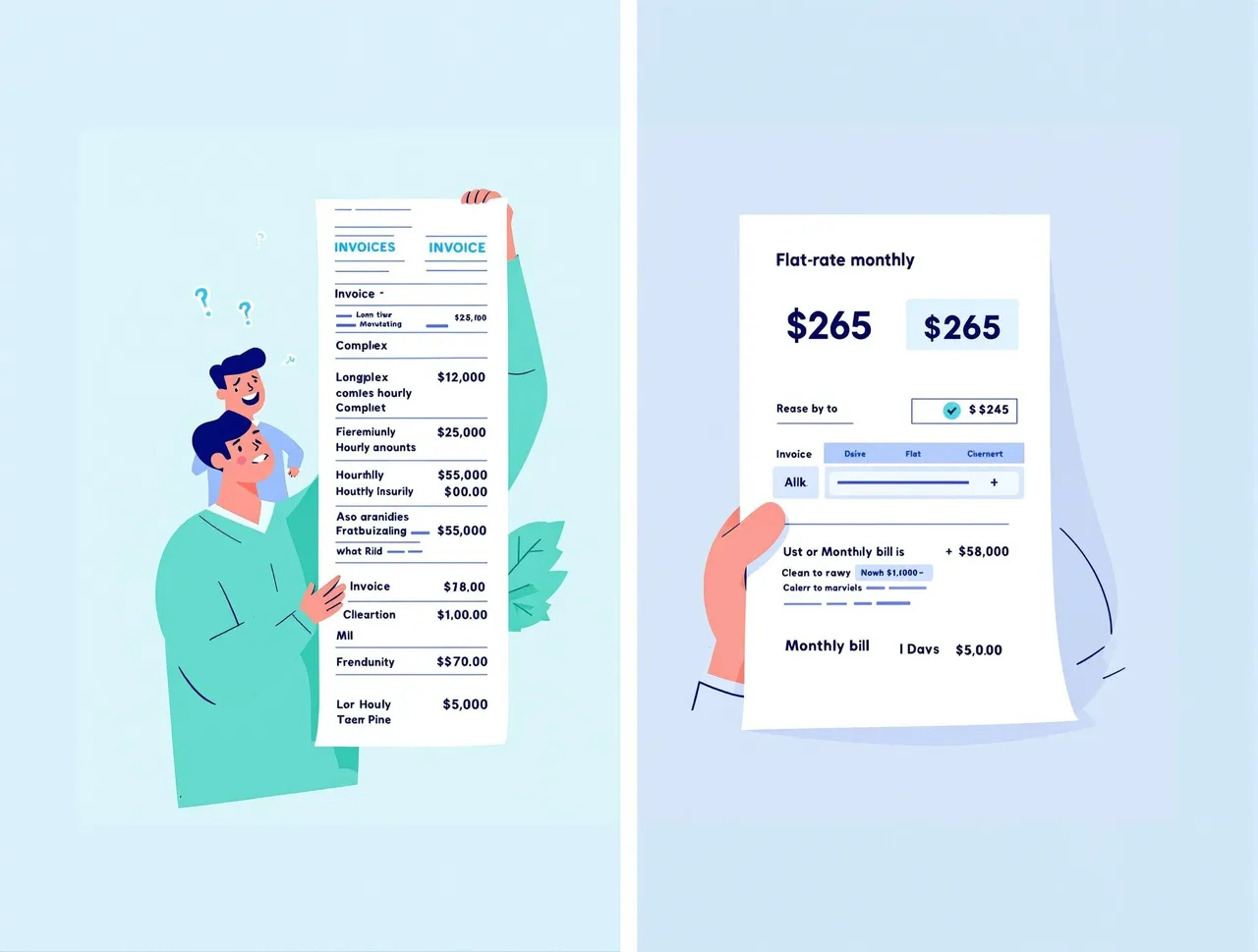

Every small business owner has faced the dreaded surprise at month-end: an unexpectedly high bill from their bookkeeper or accountant. One month it’s $400, the next it’s $800, and you’re left wondering what happened to your budget. At AIG Business Services, we’ve eliminated this uncertainty with our revolutionary fixed-price model at just Essential Starting $265 per month. Let’s explore why predictable pricing isn’t just better for your budget – it’s better for your business.

The Hidden Costs of Hourly Billing

Traditional bookkeeping services charge by the hour, typically ranging from $30 to $100 per hour depending on complexity and location. While this might seem reasonable on the surface, the reality is far more complicated. Hourly billing creates a system where you’re essentially paying for inefficiency, uncertainty, and often, work that doesn’t directly benefit your business.

Consider this scenario: Your bookkeeper spends 30 minutes trying to categorize a transaction they don’t understand, then another 20 minutes calling you for clarification, followed by 15 minutes documenting the conversation. That’s over an hour of billable time for what should have been a 5-minute task handled by someone with industry expertise. With hourly billing, you pay for their learning curve, their inefficiencies, and their lack of specialized knowledge.

The Psychology of Hourly Billing

Hourly billing creates perverse incentives that work against your interests. When service providers charge by the hour, they’re essentially rewarded for taking longer to complete tasks. There’s no incentive to streamline processes, invest in better technology, or become more efficient. In fact, efficiency directly reduces their revenue.

This model also creates a barrier to communication. How many times have you hesitated to call your bookkeeper with a question because you knew it would add to your bill? This reluctance to communicate leads to misunderstandings, errors, and missed opportunities for strategic financial guidance.

Budget Predictability: The Foundation of Smart Business Planning

Fixed-price bookkeeping transforms your financial management from a variable expense into a predictable investment. At Starting $265 per month, you know exactly what you’ll pay regardless of how complex your month becomes. This predictability allows for better budgeting, improved cash flow management, and the peace of mind that comes with knowing your costs upfront.

For growing businesses, this predictability becomes even more valuable. As your transaction volume increases, your bookkeeping needs naturally become more complex. With hourly billing, this growth directly translates to higher costs. With fixed pricing, you can scale your business without worrying about proportional increases in bookkeeping expenses.

Quality Over Quantity: The Fixed-Price Advantage

When bookkeepers aren’t watching the clock, they can focus on quality and accuracy rather than speed. Our fixed-price model allows our team to take the time needed to understand your business, implement proper systems, and provide thorough, accurate financial reporting. We’re not rushing through your books to minimize time; we’re investing the necessary effort to ensure accuracy and provide valuable insights.

This approach also enables us to invest in better technology and training. Since we’re not constrained by billable hours, we can implement automated systems, advanced software, and efficient processes that benefit our clients without increasing costs.

Comprehensive Service Inclusion

Our Starting $265 monthly fee isn’t just for basic bookkeeping. It includes everything you need for complete financial management: transaction categorization, bank reconciliation, financial statement preparation, accounts payable and receivable management, and ongoing consultation. With hourly services, each of these components typically carries separate charges, quickly escalating your total cost.

We also include services that hourly providers often charge extra for: year-end preparation, tax document organization, financial report explanations, and strategic consultations. These value-added services are part of our commitment to your success, not additional profit centers.

The Real Cost Comparison

Let’s examine the true cost difference with a realistic example. A typical small business using hourly bookkeeping services might pay:

- Basic bookkeeping: 8 hours × $50/hour = $400

- Month-end reconciliation: 3 hours × $50/hour = $150

- Financial statement preparation: 2 hours × $50/hour = $100

- Consultation calls: 1 hour × $50/hour = $50

- Total monthly cost: $700

With AIG Business Services, this same business pays Starting at $265 per month for all these services plus additional support, consultation, and peace of mind. The savings are substantial and predictable.

Industry Expertise Included

Our fixed-price model allows us to specialize in specific industries like transportation, moving companies, eCommerce, and professional services. This specialization means we understand your unique challenges, compliance requirements, and opportunities. We don’t need to spend billable hours learning about your industry because we already know it.

This expertise translates to better service, more accurate categorization, industry-specific insights, and proactive advice that can save you money and help you grow. With hourly services, you’re often paying for your bookkeeper’s education about your industry.

24/7 Support Without Hourly Charges One of the most significant advantages of our fixed-price model is unlimited access to support. Need to discuss a transaction at 8 PM? Have a question about your financial reports on the weekend? With traditional hourly services, these interactions come with additional charges. Our clients can reach out whenever they need support without worrying about the meter running.

This accessibility leads to better communication, fewer errors, and more strategic financial management. When you’re not worried about the cost of each interaction, you’re more likely to seek guidance that can benefit your business.

Technology and Efficiency Benefits

Fixed-price bookkeeping enables significant investment in technology and process improvement. We use advanced accounting software, automated data entry systems, and sophisticated reporting tools that increase accuracy and efficiency. These investments benefit our clients through better service and faster turnaround times.

With hourly billing, service providers have little incentive to invest in efficiency improvements since faster work means less revenue. Our model aligns our interests with yours: we succeed when we provide excellent service efficiently.

Scalability Without Penalty

As your business grows, your bookkeeping needs become more complex. With hourly billing, this complexity directly translates to higher costs. Our fixed-price model allows you to scale without proportional increases in bookkeeping expenses. Whether you process 100 transactions or 1,000 transactions per month, your cost remains the same.

This scalability is particularly valuable for seasonal businesses or companies experiencing rapid growth. You can focus on growing your business without worrying about escalating bookkeeping costs.

Transparency and Trust

Fixed pricing builds trust through transparency. There are no surprises, no unexpected charges, and no need to scrutinize every line item on your bill. You know exactly what you’re paying for and what you’re getting in return. This transparency allows you to focus on your business rather than monitoring your bookkeeper’s time.

The AIG Business Services Difference At AIG Business Services, our Essential Starting at $265 monthly fee represents more than just bookkeeping – it’s a comprehensive financial management partnership. We provide:

- Complete bookkeeping and financial reporting

- Payroll support and tax preparation assistance

- Industry-specific expertise and guidance

- 24/7 support and consultation

- Advanced technology and reporting tools

- Unlimited communication and support

All of this comes with no retainers, no setup fees, and no hidden charges. What you see is what you pay, month after month.

Making the Switch Transitioning from hourly to fixed-price bookkeeping is straightforward. We handle the entire process, from setting up your accounts to training you on our systems. Most clients see immediate benefits in both cost savings and service quality.

Conclusion: The choice between hourly and fixed-price bookkeeping isn’t just about cost – it’s about predictability, quality, and peace of mind. Our Essential Starting $265 monthly fee eliminates billing surprises, enables better budgeting, and provides access to comprehensive financial management services that would cost significantly more with traditional hourly billing.

Ready to experience the benefits of fixed-price bookkeeping? Contact AIG Business Services today at (833) 313-4996 or email finance@aigbiz.com to schedule your free 30-minute discovery call. Let us show you how predictable pricing can transform your business financial management.