Operating an interstate moving company requires more than just trucks and muscle – it demands strict adherence to federal regulations and substantial financial commitments. The Federal Motor Carrier Safety Administration (FMCSA) has established comprehensive requirements that can make or break your moving business. At AIG Business Services, we’ve helped numerous moving companies navigate these complex financial requirements while maintaining compliance and profitability at our fixed rate of $265 per month.

Understanding Interstate Moving Authority

Before your first truck crosses state lines ( moving interstate licence ), you need proper interstate moving authority from the FMCSA. This isn’t just a simple license – it’s a comprehensive regulatory framework that requires ongoing financial management, reporting, and compliance. The process involves multiple steps, each with specific financial implications that can significantly impact your business operations and cash flow.

The FMCSA requires interstate movers to obtain a USDOT number and operating authority (MC number). These aren’t one-time fees – they represent ongoing financial obligations that require careful planning and management. Understanding these requirements upfront helps you budget appropriately and avoid costly compliance issues down the road.

Initial Financial Requirements

The financial commitment to become a licensed interstate mover extends far beyond application fees. You’ll need to demonstrate financial responsibility through various mechanisms, each requiring significant capital allocation. The initial investment typically ranges from $15,000 to $50,000, depending on your fleet size and service scope.

Application fees alone can reach several hundred dollars, but these represent just the beginning of your financial obligations. The real costs come from insurance requirements, bonding obligations, and the ongoing compliance expenses that many new operators underestimate.

Insurance Requirements: Your Largest Financial Obligation

Interstate moving companies must maintain specific insurance coverage levels that often represent their largest ongoing expense after payroll. Cargo insurance requirements vary based on the type of goods you transport, with minimum coverage starting at $5,000 per vehicle for general commodities and scaling up to $100,000 or more for high-value items.

Public liability insurance requirements are equally substantial, with minimum coverage of $750,000 for vehicles weighing 10,001 pounds or more. For larger vehicles exceeding 26,001 pounds, this requirement jumps to $1 million. These aren’t optional expenses – they’re mandatory for maintaining your operating authority.

The financial impact extends beyond premium payments. Insurance companies often require substantial deposits, and your coverage costs will fluctuate based on your safety record, claims history, and operational scope. Smart financial planning includes budgeting for potential premium increases and maintaining reserves for deductible payments.

Insurance Requirements: Your Largest Financial Obligation

Interstate moving companies must maintain specific insurance coverage levels that often represent their largest ongoing expense after payroll. Cargo insurance requirements vary based on the type of goods you transport, with minimum coverage starting at $5,000 per vehicle for general commodities and scaling up to $100,000 or more for high-value items.

Public liability insurance requirements are equally substantial, with minimum coverage of $750,000 for vehicles weighing 10,001 pounds or more. For larger vehicles exceeding 26,001 pounds, this requirement jumps to $1 million. These aren’t optional expenses – they’re mandatory for maintaining your operating authority.

The financial impact extends beyond premium payments. Insurance companies often require substantial deposits, and your coverage costs will fluctuate based on your safety record, claims history, and operational scope. Smart financial planning includes budgeting for potential premium increases and maintaining reserves for deductible payments.

Interstate moving companies must maintain extensive records that require robust financial management systems. Driver qualification files, vehicle maintenance records, trip reports, and customer documentation all require systematic organization and storage. The financial impact includes both the direct costs of record keeping and the potential penalties for inadequate documentation.

Modern record keeping often requires investment in specialized software, digital storage systems, and administrative personnel. These costs should be factored into your overall compliance budget, as inadequate record keeping can result in substantial fines and potential loss of operating authority.

The True Cost of Non-Compliance

The financial penalties for non-compliance with interstate moving regulations can be devastating. FMCSA fines can reach tens of thousands of dollars for serious violations, and loss of operating authority can shut down your business entirely. The indirect costs – lost revenue, legal fees, and reputation damage – often exceed the direct penalties.

Understanding these risks helps justify the investment in proper compliance programs. The cost of maintaining compliance is always less than the cost of violations, making professional financial management essential for long-term success.

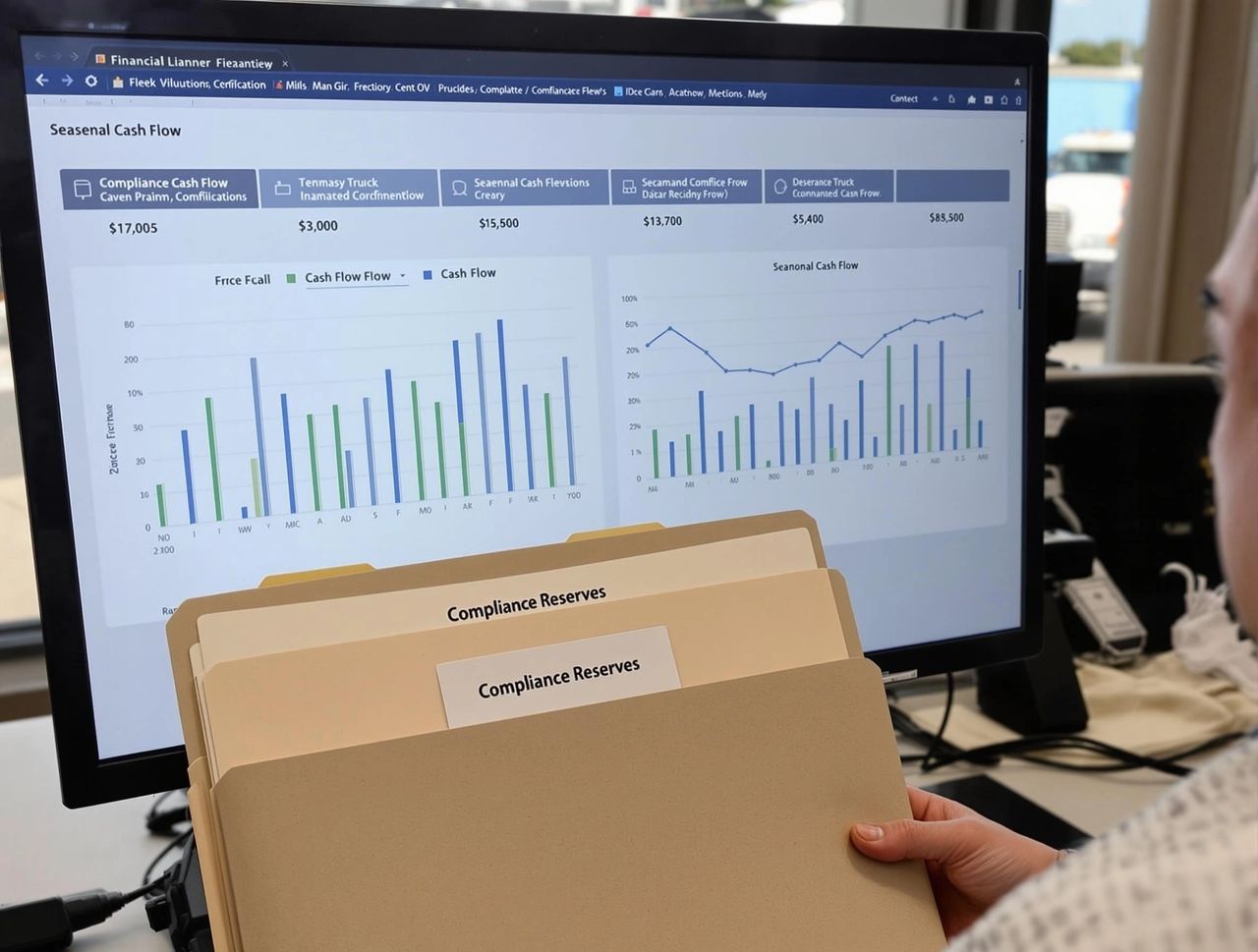

Cash Flow Management for Compliance

Interstate moving companies face unique cash flow challenges related to compliance requirements. Insurance premiums, bonding costs, and regulatory fees often come due at different times throughout the year, creating potential cash flow crunches. Effective financial planning includes establishing reserves for these predictable but irregular expenses.

Seasonal variations in moving demand compound these cash flow challenges. Summer months typically generate higher revenue, but compliance costs remain constant throughout the year. Smart financial management includes building reserves during peak seasons to cover compliance costs during slower periods.

Technology and Compliance Integration

Modern interstate moving companies increasingly rely on technology to manage compliance requirements efficiently. Electronic logging devices (ELDs), fleet management systems, and compliance software all require financial investment but can significantly reduce long-term compliance costs.

The initial investment in compliance technology can be substantial, but the long-term benefits include reduced administrative costs, improved accuracy, and better audit preparation. These systems also provide the detailed financial tracking necessary for effective business management.

Working with Financial Professionals

The complexity of interstate moving compliance makes professional financial management essential. At AIG Business Services, we understand the unique challenges facing interstate movers and provide specialized support for compliance-related financial management. Our fixed-price model at $265 per month includes tracking compliance expenses, managing cash flow for irregular payments, and ensuring proper documentation for regulatory requirements.

Our expertise in the transportation industry means we understand the specific financial challenges of interstate moving operations. We help clients budget for compliance costs, manage cash flow around irregular expenses, and maintain the financial records necessary for regulatory compliance.

Planning for Growth

As your interstate moving business grows, compliance requirements and associated costs typically increase. Additional vehicles require additional insurance coverage, larger operations face enhanced safety requirements, and expanded service areas may trigger additional state-level obligations.

Effective financial planning includes modeling these increased compliance costs as part of your growth strategy. Understanding how expansion affects your regulatory obligations helps ensure that growth remains profitable after accounting for increased compliance expenses.

Conclusion: Interstate moving licenses represent a significant financial commitment that extends far beyond initial application fees. From substantial insurance requirements to ongoing compliance costs, the financial obligations of interstate moving operations require careful planning and professional management. Success in this highly regulated industry depends on understanding these requirements and maintaining the financial discipline necessary for ongoing compliance.

Ready to navigate interstate moving compliance with confidence? Contact AIG Business Services today at +1-(833) 313-4996 or email finance@aigbiz.com to schedule your free 30-minute discovery call. Let our transportation industry expertise help you manage the financial complexities of interstate moving operations.